There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

A blog for thoughtful market participants

Many people who struggle in options trading are highly capable in their own fields.

They are successful Engineers, Doctors, MBAs, CAs, Senior Executives, and Working Professionals - people who are used to solving hard problems.

- They work long hours.

- They read.

- They think deeply.

- They prepare thoroughly.

- And in their professions, they often lead.

- In most areas of life, these traits are enough to succeed.

Options trading works differently.

Here, effort does not always translate into results.

Intelligence does not automatically convert into consistency.

This gap - between capability and outcome - is far more common than it appears.

"The market does not test how smart you are. It tests how calmly and consistently you act."

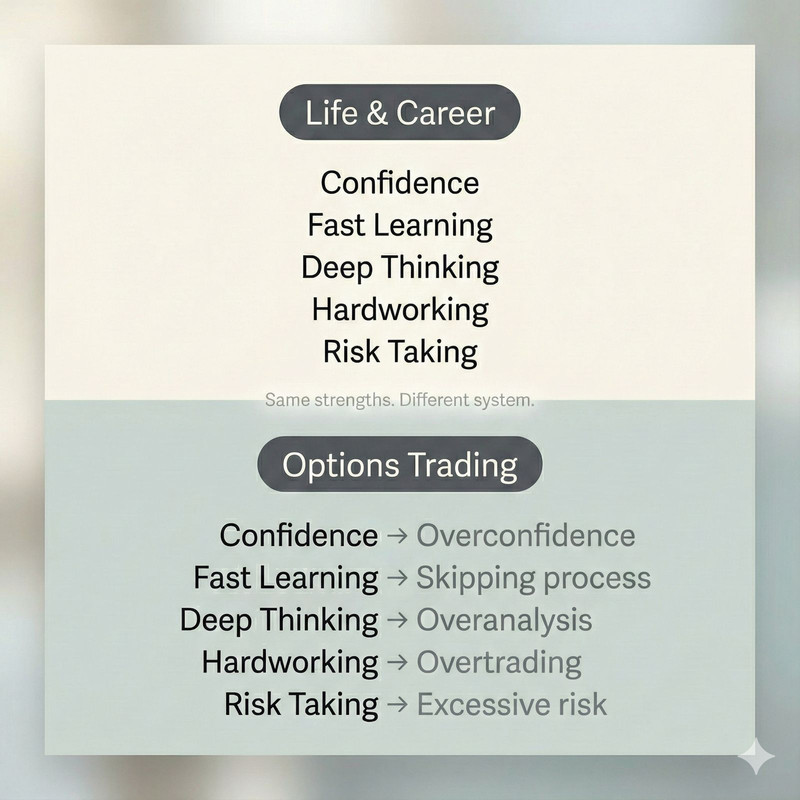

The qualities that help you succeed in life

don't always help in trading.

In options trading,

some strengths quietly turn into problems.

These strengths help you succeed everywhere else - but in trading, they need reframing.

"I understand this now"

"I pick things quickly"

"I like to analyse properly"

"The more I do, the more I make"

"No risk, no reward"

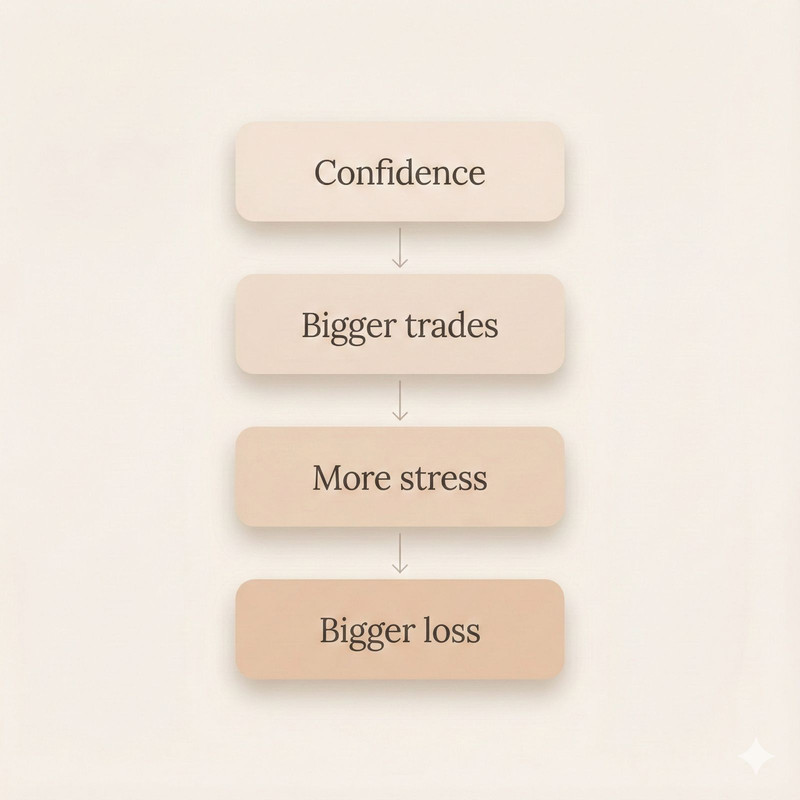

- When confidence grows fast,

- positions also become big.

- Small mistakes then

- become big losses.

Options trading needs control, not confidence.

- When you learn fast,

- you feel ready before you are.

- Real markets are different

- from what you studied.

Markets reward patience, not speed of learning.

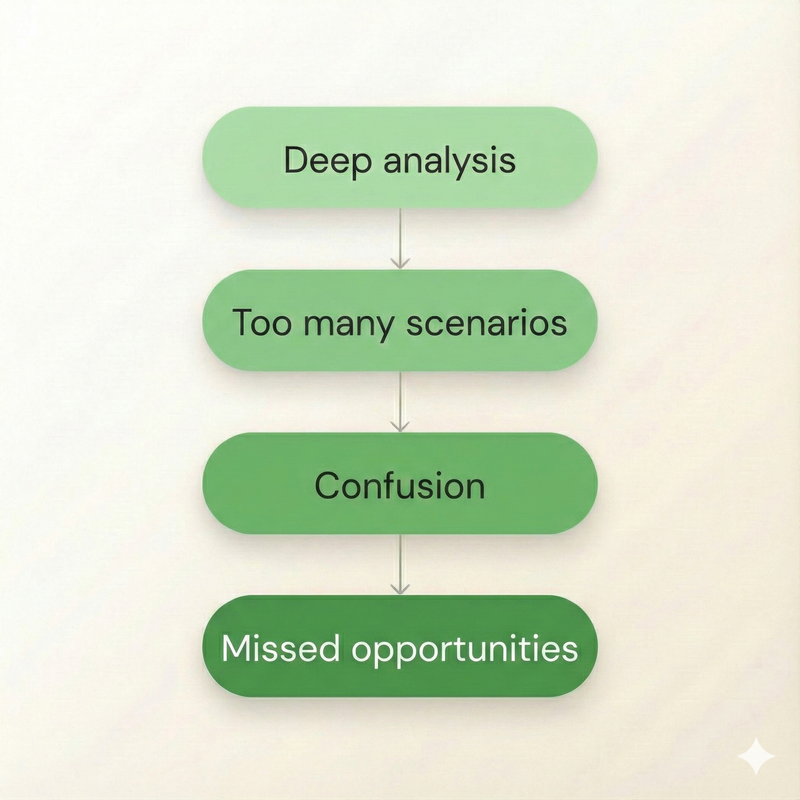

- When you think too deeply,

- you see problems everywhere.

- Every trade feels uncertain.

- Fear takes over decisions.

Simple systems beat complex analysis in trading.

- High work ethic

- Need to feel busy

- Forced trades

- Unnecessary losses.

Activity does not equal profitability. Sometimes the hardest work is waiting.

- When you take big risks,

- big wins feel amazing.

- But one wrong move

- erases weeks of work.

Consistent small gains beat occasional big wins.

You don't need to quit trading.

You don't need to gamble.

You just need a better method.

Four simple principles that change everything.

Market-neutral strategies remove the need to predict price movements

Build trades with statistical edges rather than market forecasts

Define maximum loss and position sizing before placing any trade

Master strategies through paper trading before risking real capital

Good traders stay calm.

Great traders stay prepared.

Paper trading builds confidence without fear.

Practice builds habit.

Habit builds discipline.

Join our three-hour workshop every Saturday, where I teach a market-neutral approach to designing option trades with a high probability of profit.

This page is written for people who are capable,

hard-working and sincere -

but tired of losses.

If you feel stuck and want clarity,

you can write to me directly.

- Kundan Kishore